how to keep mileage for taxes

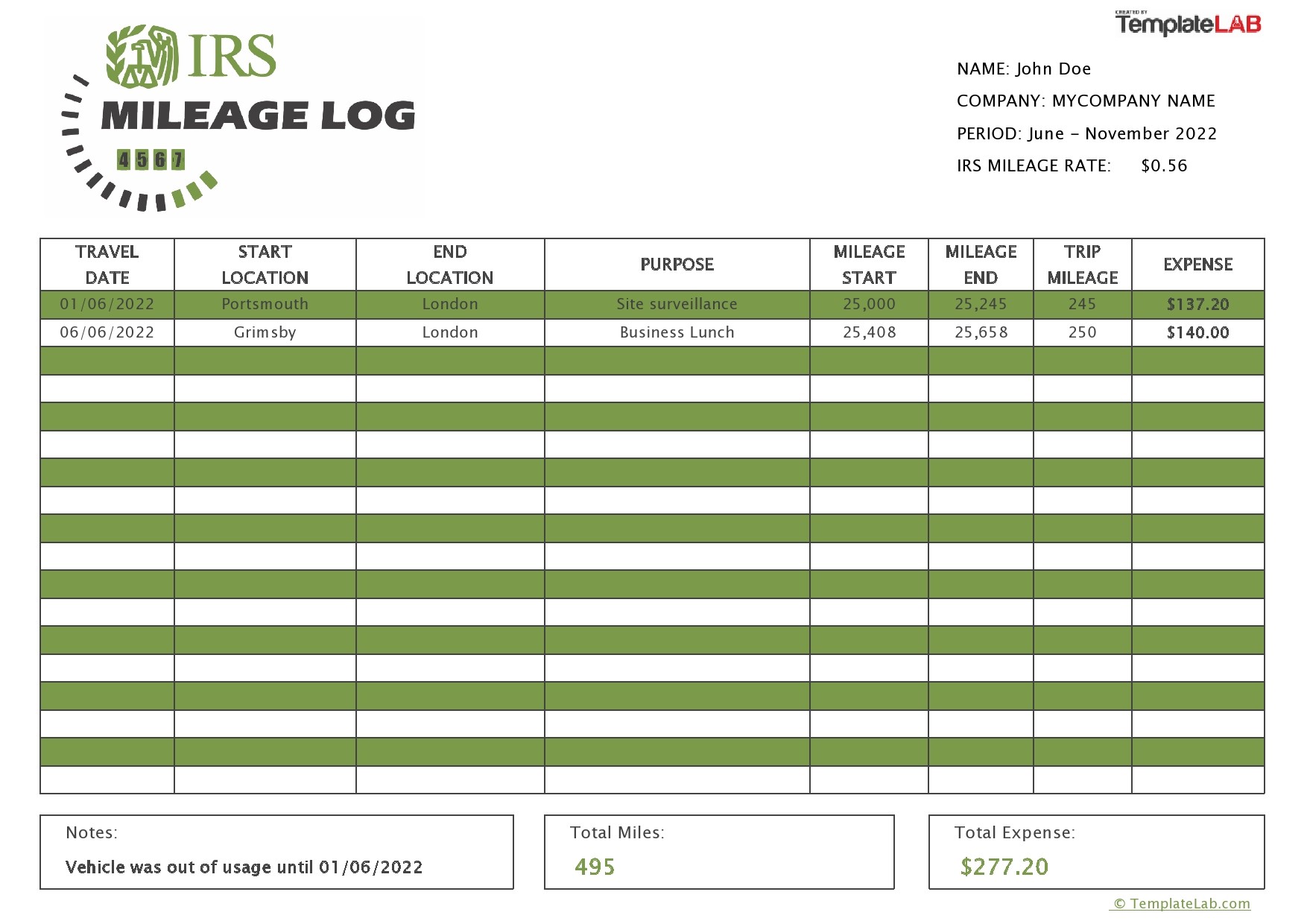

IRS regulations for taxpayers who choose to deduct the standard mileage rate require a log showing miles traveled destination and business purpose You do not include. The mileage for each.

Should I Track Miles For Taxes Keeper

The standard mileage rate is the most simple and straightforward way to claim your business expenses.

. If you decide to go with the Standard Mileage Deduction over the Actual Expense Method all you have to do is track your qualifying miles and multiply it by the cents per mile. Keep your log with MileageWise and save. For 2021 the standard rate is 56 cents per mile.

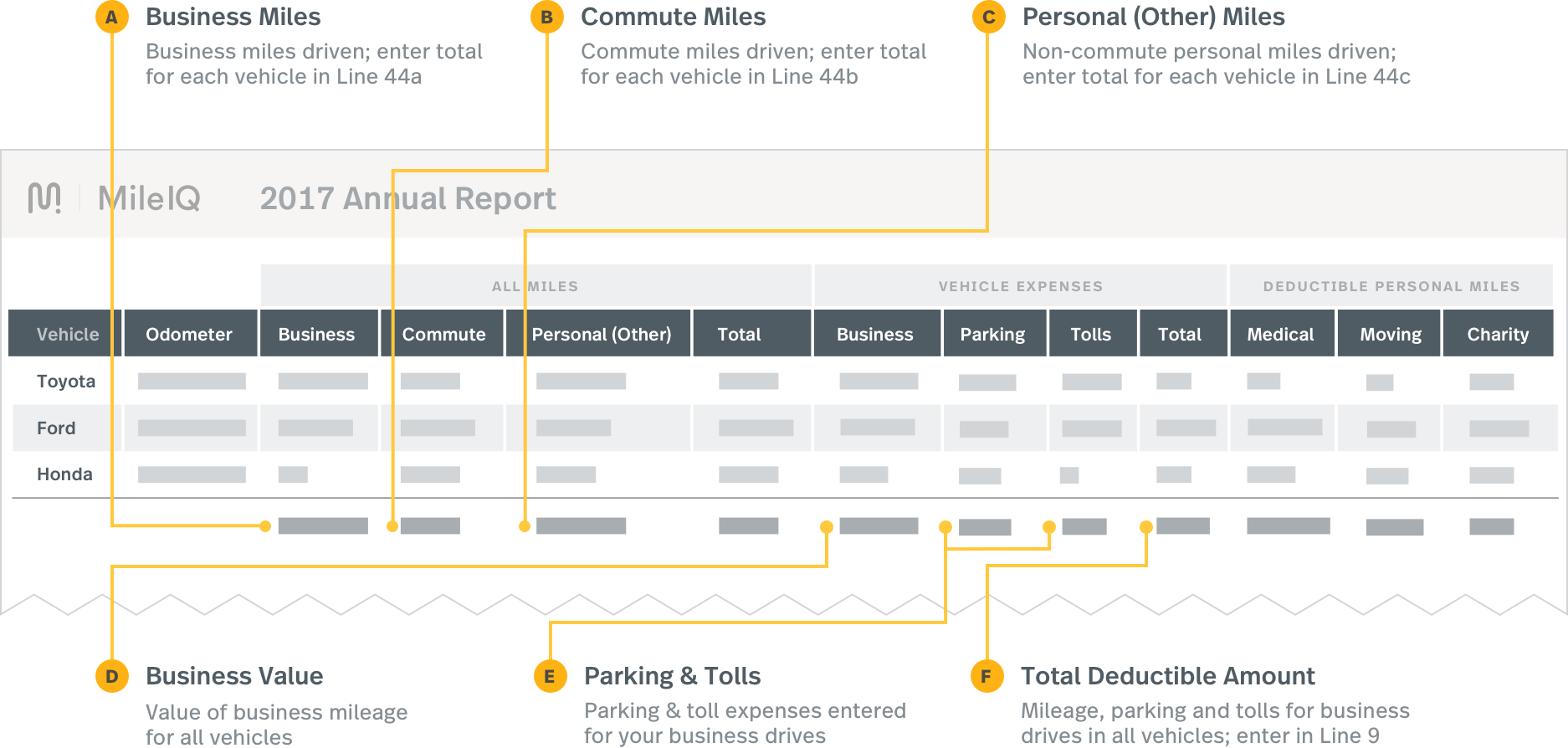

Use the standard mileage rate. In addition to providing the number of miles driven during the. It allows you to track your mileage log for taxes your time distance and speed.

How To Track And Keep Records Of Your Mileage. The IRS defines adequate records. So how do you keep track of mileage for taxes.

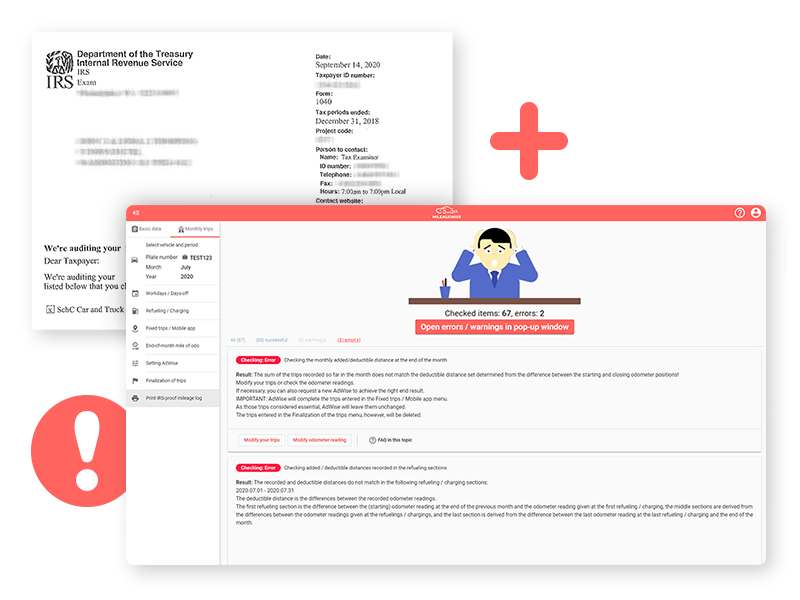

MileageWise is an automatic mileage tracking app that is available for both iPhone and Android. Best methods for tracking mileage for taxes. Begin mileage tracking Mileage tracking is made easy thanks to MileIQ.

You would then multiply your total actual driving expenses by 75 to get the amount to use for the expense deduction. Standard Mileage Deduction. This is the easier way as you only need to track the number of miles you drive in a year for business purposes then you multiply it by IRSs.

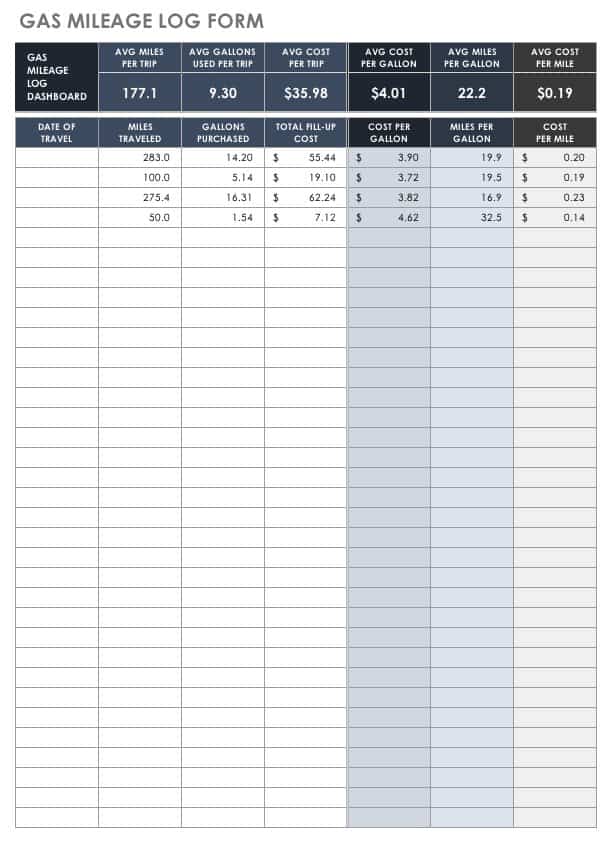

There are a few ways you can keep track of your mileage for taxes. The easiest way to calculate business. Keep your log on Paper and pay with your Time for beginners only Keep your log with Free or Cheap software and pay the IRS Fine.

The Internal Revenue Service IRS says you must keep accurate records of business expenses including for business automobile expenses. If you choose the standard deduction method youll find our advanced automatic mileage tracking is the most. Using this deduction requires only that you keep a log of all qualifying mileage driven.

You must log your. Your mileage for the year The places you drove for business Dates for your drives The business reason for your trip The IRS also wants to know your total. This is true whether you.

Note During an audit the IRS can ask you to prove. Mileage tax deductions can be claimed by small business owners self-employed individuals independent contractors including rideshare drivers reservists qualified. All you need to do is keep track of your total business miles driven for the.

So if your cars total mileage is 10000 miles you would times it by 60 6000 and then multiply it by the standard mileage rate or 56 cents per mile for 2021. There are two methods you can use to claim your mileage deduction. How to deduct mileage for taxes for the self employed Self-employed individuals will report their mileage on the Schedule C form.

To use this method you track your mileage for business purposes and. For all transportation the IRS asks that you log the following. Your total tax deduction would.

Reporting Mileiq Mileage With Tax Software Mileiq

Should I Track Miles For Taxes Keeper

Does Doordash Track Miles How Mileage Tracking Works For Dashers

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Free Uk Mileage Log Template Zervant

Free Mileage Log Template Download Ionos

Free Mileage Log Templates Smartsheet

How To Keep Track Of Mileage For Taxes In 2022 Save Your Money

25 Printable Irs Mileage Tracking Templates Gofar

Free Mileage Log Templates Smartsheet

20 Printable Mileage Log Templates Free ᐅ Templatelab

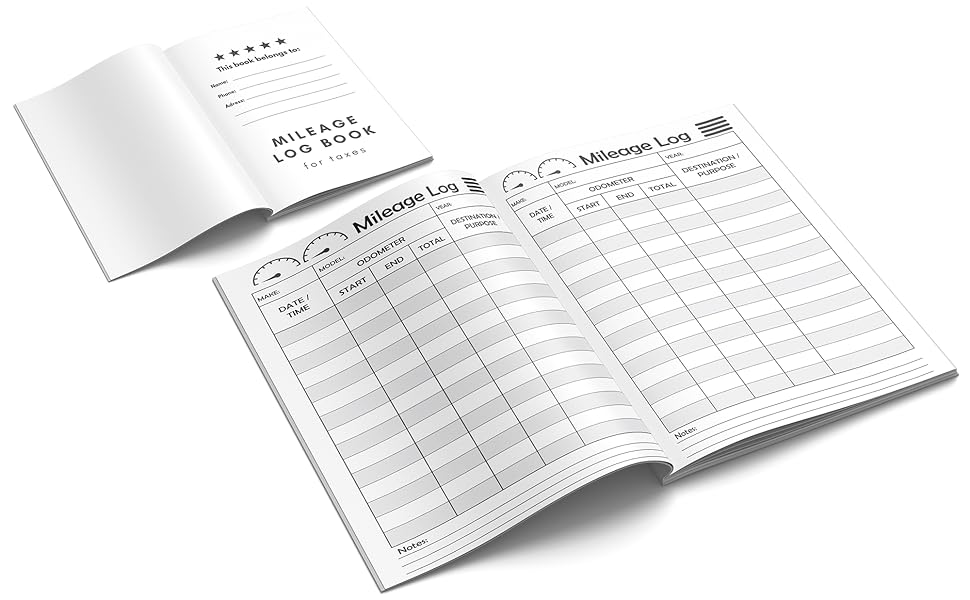

Amazon Com Mileage Log Book For Taxes A Mileage Logbook For Businesses To Record Vehicle Miles Traveled To Claim A Tax Deduction Keep Track Of Date Purpose Destination Odometer Readings And Total Miles

How To Keep Track Of Mileage For Taxes In 2022 Save Your Money

How To Take A Tax Deduction For The Business Use Of Your Car

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

Mileage Log Book For Taxes Auto Mileage Tracker To Record And Track Your Daily Mileage For Taxes Car Tracker For Business Auto Driving Record Books For Taxes Vehicle Expense Parker Johnny Amazon Com